No Fault Divorce

Nevada, like every other state, allows for a no-fault divorce. In fact, Nevada is a “pure” no-fault divorce state. In other words, spouses seeking to divorce can only file for no-fault reasons such as irreconcilable differences. No one can legally allege improper behavior such as adultery as a reason to file for divorce.

However, if you are, or were, wasting marital resources on a third party, those funds could come out of your share of the marital property distribution. Waste or dissolution of marital assets may be alleged when a party spends amounts on gifts, vacations, or rent for a non-spouse. Outside of wasting your marital assets on your new relationship, you needn’t worry about fault allegations when considering whether to date or not. However, just because you can do something it doesn’t mean you should.

Child Custody Considerations

Family courts base child custody decisions on the best interests of the children. Introducing a new party into the lives of your children can be a disadvantage during the divorce process. This is particularly true if the new third party has a history of criminal behavior, mental health issues, or drug/alcohol abuse. In these instances, any qualified divorce lawyer retained by your spouse should argue that the presence of the new third party poses risks to the children. This could have a serious negative affect on a child custody determination. It’s also true that this could affect your child custody rights post-divorce. In either situation, you should carefully consider any new cohabitation arrangement when you have shared minor children.

Alimony and Cohabitation

Nevada courts may order one of several different types of alimony depending on the circumstance of the spouses. In general, alimony can be short-term with a set end date, rehabilitative, or permanent. In all cases, alimony is based upon the idea that one ex-spouse needs support from the other in order to be financially stable and independent. Any competent divorce attorney will include a clause in the final decree of divorce that ends alimony in the case of remarriage.

Additionally, since cohabitation is now so socially accepted, it may also be included as a reason to cease alimony payments. In Nevada, termination of alimony based on cohabitation usually requires that the new partner is financially supporting the recipient ex-spouse, thus removing the need for alimony payments. Merely entering into a new relationship before, during, or after your divorce does not constitute sufficient cohabitation to end the need for alimony. If you choose to date during your divorce you should nevertheless be wary. An aggressive divorce attorney on the other side may argue that your new partner is financially supporting you, thus reducing or eliminating your need for alimony.

Resolving the Divorce Amicably is Always Best

Divorces can be amicable or hard-fought. How the divorce process resolves depends in part on the complexity and significance of contested issues such as alimony, child custody, and the division of community property. It also depends on the personalities of the divorcing spouses and their relationship with one another. Dating while the divorce process is ongoing can create anger or resentment in your soon-to-be ex-spouse. In any event, you should never publicize your new relationship on social media and brag about how happy you are now. A divorce that could have been quickly and quietly resolved through your divorce lawyer’s negotiations might turn into a nasty court battle. If you can wait a few months to begin seeing other people or publicly announce the start of a new relationship, it is in your overall best interests to do so.

Legal Advice and Representation for Your Las Vegas Divorce

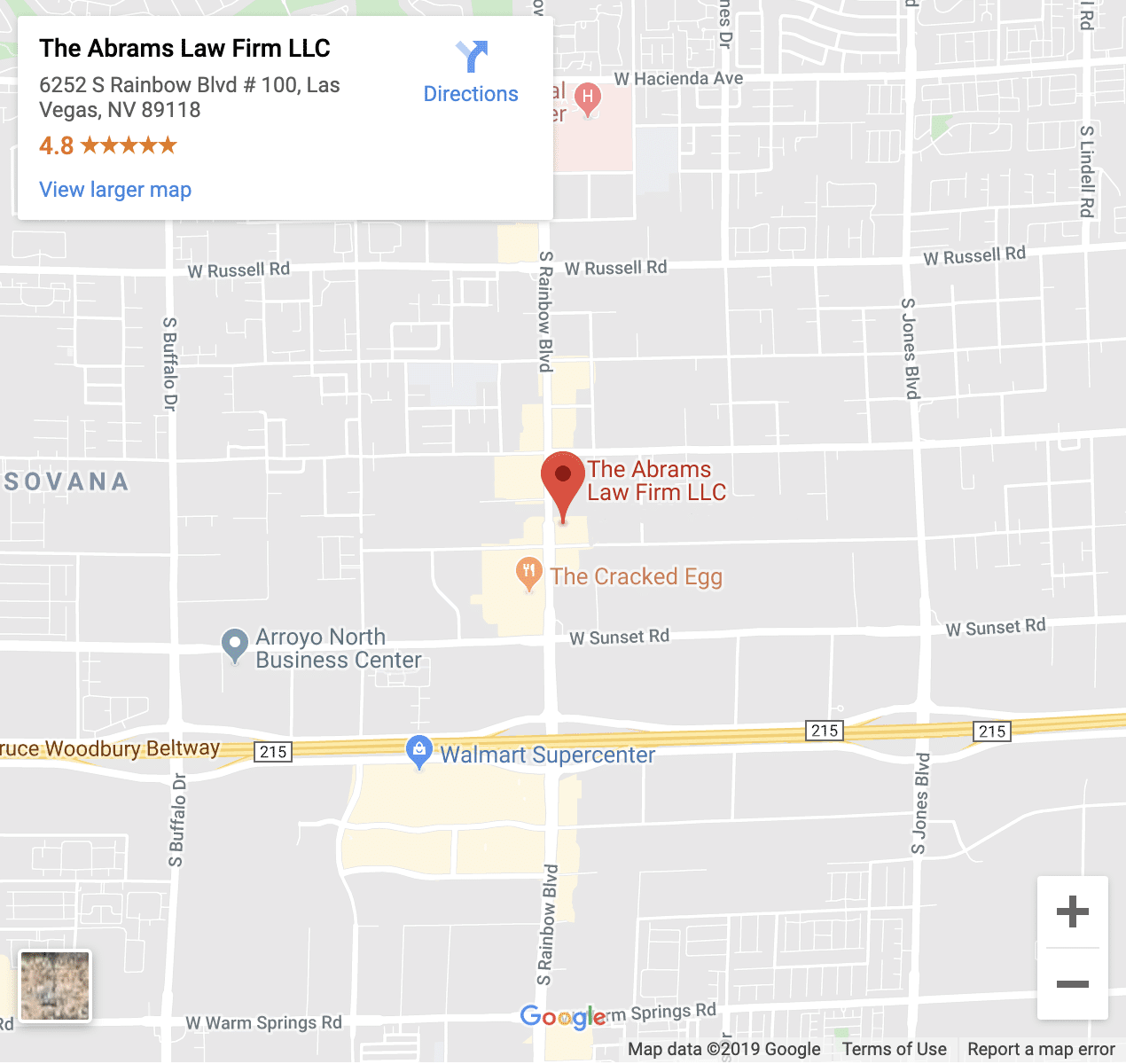

We are ready to lead you through all aspects of your divorce case, including division of complex assets, alimony, and child custody disputes. Our Las Vegas divorce attorneys will speak to you directly and assist you in setting up a consultation. Call our office at 702-222-4021 to speak with one of them and see if what we offer is right for you.

Every divorce involves the distribution of marital property in some form. Different states have different rules about what constitutes marital property. Complicating the divorce process are issues such as separate property before marriage and prenuptial and post nuptial agreements. These are some of the different factors family courts will use in evaluating who gets what share of which property. Below, our experienced

Every divorce involves the distribution of marital property in some form. Different states have different rules about what constitutes marital property. Complicating the divorce process are issues such as separate property before marriage and prenuptial and post nuptial agreements. These are some of the different factors family courts will use in evaluating who gets what share of which property. Below, our experienced

Divorce can be a complex, lengthy, and a difficult process when both spouses live in the same place. But when one spouse lives outside the United States, the challenges can be even greater. Divorcing spouses and their divorce lawyers will need to take into account questions concerning residency, international child custody, foreign assets, and other matters on top of the usual divorce issues. International divorce matters are complicated by their nature. If you are going through a divorce and you or your spouse resides in a different country, you’ll need the expertise of a

Divorce can be a complex, lengthy, and a difficult process when both spouses live in the same place. But when one spouse lives outside the United States, the challenges can be even greater. Divorcing spouses and their divorce lawyers will need to take into account questions concerning residency, international child custody, foreign assets, and other matters on top of the usual divorce issues. International divorce matters are complicated by their nature. If you are going through a divorce and you or your spouse resides in a different country, you’ll need the expertise of a

All divorce matters require the division of assets and debts. Both spouses are required to be completely forthcoming concerning their finances. The assets generally fall into two categories: community property or separate. A third possible category is when the assets are partially commingled which means that marital assets were used in support of a “separate property” asset. Separate assets must be disclosed because they can be relevant when determining issues such as alimony and child support. These are complex financial issues.

All divorce matters require the division of assets and debts. Both spouses are required to be completely forthcoming concerning their finances. The assets generally fall into two categories: community property or separate. A third possible category is when the assets are partially commingled which means that marital assets were used in support of a “separate property” asset. Separate assets must be disclosed because they can be relevant when determining issues such as alimony and child support. These are complex financial issues.

If it’s not specifically requested and handled properly, divorce proceedings can be the ultimate form of “airing your dirty laundry” in public. The fact that your marital relationship is ending isn’t the only issue that becomes public. Details of your private life make their way into public court filings and hearings insofar as they relate to the proceedings. Divorce related disputes, including personal and financial details concerning your children and your property, are also available to anyone who cares to find them.

If it’s not specifically requested and handled properly, divorce proceedings can be the ultimate form of “airing your dirty laundry” in public. The fact that your marital relationship is ending isn’t the only issue that becomes public. Details of your private life make their way into public court filings and hearings insofar as they relate to the proceedings. Divorce related disputes, including personal and financial details concerning your children and your property, are also available to anyone who cares to find them.

Divorce matters are complicated for a variety of reasons. Divorces involve complex and heated emotional issues, affect the lives of both parties and their children, and can impact your financial security. Some people consider continuing to live with their spouse during the divorce proceeding. They also may think that keeping the family together can help the children through the transition. As we mentioned in a recent post, we strongly advocate against living with your future ex during your divorce case. The consequences far outweigh any benefits of doing so. In this article, we cover a few of the reasons why living with your spouse during a divorce is a bad idea.

Divorce matters are complicated for a variety of reasons. Divorces involve complex and heated emotional issues, affect the lives of both parties and their children, and can impact your financial security. Some people consider continuing to live with their spouse during the divorce proceeding. They also may think that keeping the family together can help the children through the transition. As we mentioned in a recent post, we strongly advocate against living with your future ex during your divorce case. The consequences far outweigh any benefits of doing so. In this article, we cover a few of the reasons why living with your spouse during a divorce is a bad idea.

Prenuptial agreements, often called “prenups,” are contracts entered into between parties in anticipation of marriage. Prenups are increasingly common among couples marrying in the 21st Century, and no longer just reserved for the wealthy and the famous. Family courts may, or may not, defer to prenuptial agreements when it comes to dividing marital property and deciding other economic issues in a divorce. If you are stuck with a prenup that leaves you with nothing or less than you deserve, what are your options? We discuss how you can challenge a Las Vegas prenuptial agreement below.

Prenuptial agreements, often called “prenups,” are contracts entered into between parties in anticipation of marriage. Prenups are increasingly common among couples marrying in the 21st Century, and no longer just reserved for the wealthy and the famous. Family courts may, or may not, defer to prenuptial agreements when it comes to dividing marital property and deciding other economic issues in a divorce. If you are stuck with a prenup that leaves you with nothing or less than you deserve, what are your options? We discuss how you can challenge a Las Vegas prenuptial agreement below.

Spouses going through divorce proceedings in Las Vegas are often surprised to learn how strongly the legal system encourages reaching an agreement outside of family court. Conducting a full trial and having the judge decide the matter is typically the last resort, costing the divorcing spouses involved more time, stress, and money. Therefore family judges presiding over Las Vegas divorce matters routinely encourage spouses to reach an agreement either by settlement negotiations through their respective Las Vegas divorce attorneys, or through mediation. In divorce matters involving child custody disputes, the family court actually requires the parents to enter mediation under Nevada State law.

Spouses going through divorce proceedings in Las Vegas are often surprised to learn how strongly the legal system encourages reaching an agreement outside of family court. Conducting a full trial and having the judge decide the matter is typically the last resort, costing the divorcing spouses involved more time, stress, and money. Therefore family judges presiding over Las Vegas divorce matters routinely encourage spouses to reach an agreement either by settlement negotiations through their respective Las Vegas divorce attorneys, or through mediation. In divorce matters involving child custody disputes, the family court actually requires the parents to enter mediation under Nevada State law.

Most business owners invest their savings and countless hours to make their business a success. And with almost half of new businesses failing within five years, there certainly are no guarantees. So when one or both divorcing spouses own a business, the process becomes complicated. Every business owner should know about divorce and business valuators.

Most business owners invest their savings and countless hours to make their business a success. And with almost half of new businesses failing within five years, there certainly are no guarantees. So when one or both divorcing spouses own a business, the process becomes complicated. Every business owner should know about divorce and business valuators.

Divorcing spouses in Nevada have to disclose their financial condition to the court. This includes a full listing of all their assets. This procedure is meant to ensure that all marital assets are disclosed and therefore subject to division during their divorce case. However, there are instances where spouses try to hide assets through unfair means. Our divorce attorneys in Las Vegas provide valuable information about marital finances, including what we do to uncover the hidden assets for your benefit.

Divorcing spouses in Nevada have to disclose their financial condition to the court. This includes a full listing of all their assets. This procedure is meant to ensure that all marital assets are disclosed and therefore subject to division during their divorce case. However, there are instances where spouses try to hide assets through unfair means. Our divorce attorneys in Las Vegas provide valuable information about marital finances, including what we do to uncover the hidden assets for your benefit.

Getting a divorce is a difficult situation for both spouses. It’s more so if the divorce involves a small business. Business owners going through divorce inherently have a complex divorce matter. Therefore, we’ve created this Las Vegas Divorce Guide for Business Owners. Your business may be the largest marital asset. One or both spouses likely worked long and hard to build it. Now it’s time for a new phase and the challenges that go with it. This guide is not a substitute for, nor is it meant to be, direct legal advice. Rather our

Getting a divorce is a difficult situation for both spouses. It’s more so if the divorce involves a small business. Business owners going through divorce inherently have a complex divorce matter. Therefore, we’ve created this Las Vegas Divorce Guide for Business Owners. Your business may be the largest marital asset. One or both spouses likely worked long and hard to build it. Now it’s time for a new phase and the challenges that go with it. This guide is not a substitute for, nor is it meant to be, direct legal advice. Rather our